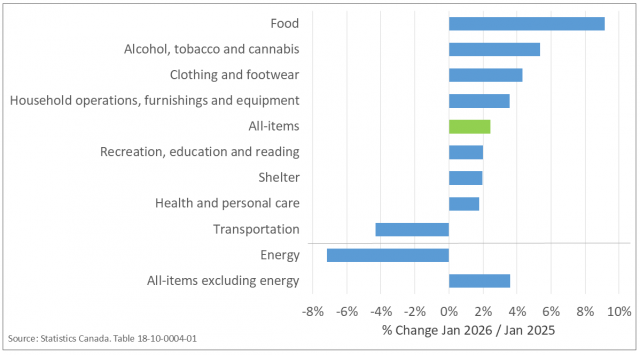

According to the Consumer Price Index (CPI), consumers in Newfoundland and Labrador paid 2.4% more for goods and services in January 2026 than in January 2025.

Prices increased in most major categories in January 2026 compared to January 2025, led by ‘Food’, ‘Alcoholic beverages, tobacco products and recreational cannabis’ and ‘Clothing and footwear’.

- The large increase in prices for these three categories is mostly related to the temporary GST/HST reduction that was implemented by the federal and provincial governments from December 14, 2024, to February 15, 2025, on essentials such as certain food items and restaurants, children’s clothing and toys, books, as well as some non-essential items such as alcoholic beverages.

- In January 2026, ‘Food’ prices increased by 9.2% compared to January 2025. There was an increase in prices for both ‘Food purchased from stores’ (+5.9%) and ‘Food purchased from restaurants’ (+16.8%) in January.

- Price increases for food purchased from stores were largely attributable to ‘Sugar and confectionery’ (+25.5%), ‘Coffee and tea’ (+25.2%) and ‘Fresh or frozen beef’ (+21.1%).

- Prices for ‘Alcoholic beverages, tobacco products and recreational cannabis’ rose by 5.4%, mainly due to a 9.2% rise in prices for ‘Alcoholic beverages’.

- The increase in prices for ‘Clothing and footwear’ (+4.3%) was boosted by a substantial increase in ‘Children’s clothing’ (+32.2%).

- Growth in ‘Shelter’ prices moderated to a 2.0% increase.

- A slight decline in the ‘Rented accommodation’ index (-0.4%), which includes rent costs, was offset by an increase in the ‘Owned accommodation’ index (+1.6%), which includes mortgage interest costs. While the mortgage interest cost index is not available for Newfoundland and Labrador, at the national level it rose at a slower pace year-over-year in January (+1.2%), with growth slowing in every consecutive month after peaking at 30.9% in August 2023.

- Also, a decline in ‘Fuel oil and other fuels’ (-1.9%) was offset by an increase in ‘Electricity’ (+6.9%). Electricity rates in Newfoundland and Labrador increased by an average of 7.0% for residential consumers, effective July 1, 2025, by Newfoundland Power, the province’s primary retailer of electric power.

- ‘Energy’ prices decreased by 7.2%, mainly due to a decline in ‘Gasoline’ prices (‑17.9%), as well as the aforementioned decrease in ‘Fuel oil and other fuels’.

- The year-over-year price decrease for gasoline in January was influenced by the removal of the consumer carbon price, effective April 1, 2025, but also due to a lower price of Brent crude oil compared to the previous year. Brent averaged US$66.60 in January 2026, a decline of 16.0% in comparison to January 2025.

The ‘All-items excluding energy’ index increased by 3.6% in January 2026 compared to January 2025.

At the national level, the CPI rose by 2.3% on a year-over-year basis in January 2026 compared to January 2025. Among provinces, the highest inflation rate was in Quebec (+3.0%), while the lowest was tied at 1.8% for both Prince Edward Island and Saskatchewan.

On a seasonally adjusted basis, consumer prices in Canada increased by 0.1% from December 2025 to January 2026. Seasonally adjusted CPI data are not available for Newfoundland and Labrador.

The United States CPI for all urban consumers increased by 2.4% in January 2026 compared to January 2025. The seasonally adjusted series increased by 0.2% in January 2026 compared to December 2025.

Year-Over-Year Change in CPI, January 2026 vs. January 2025

Statistical Reference: For the latest in consumer price index statistics visit the Newfoundland & Labrador Statistics Agency site and check the release dates on the Statistics Canada site.