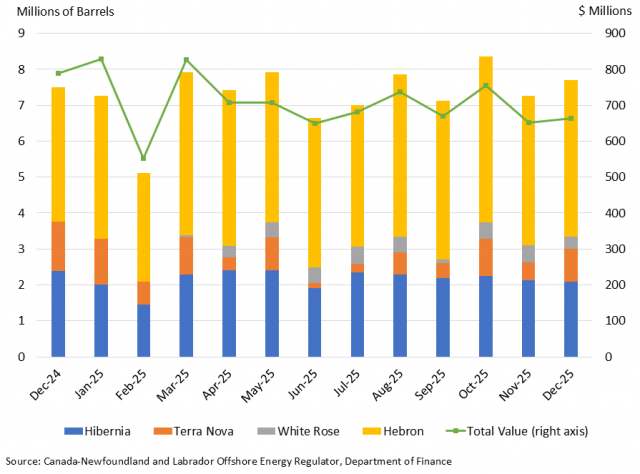

According to the Canada-Newfoundland and Labrador Offshore Energy Regulator (C-NLOER), 7.7 million barrels of oil were extracted from offshore Newfoundland and Labrador in December 2025, an increase of 2.6% compared to December 2024. The corresponding value of production totalled $663.8 million, a decrease of 15.8%.

- Production increased at Hebron, but these gains were partially offset by lower production at Hibernia and Terra Nova. Production resumed at the White Rose oilfield on March 13, 2025, after being shut down since January 2024 for the SeaRose FPSO to undergo a refit as part of the field’s asset life extension project.

- Brent crude oil prices averaged US$62.54/barrel in December 2025, a 15.3% decrease from US$73.86/barrel in December 2024.

The global oil market continues to be shaped by OPEC+ production decisions, U.S. tariff actions, and a range of geopolitical developments. Oversupply conditions and rising global inventories are also exerting downward pressure on prices.

- Through July 2025, OPEC+ maintained voluntary production cuts that helped support prices, even as the group began to unwind these cuts in the second quarter. Larger monthly production increases were implemented in August (approximately 548,000 barrels per day) and again in October, before the pace slowed to roughly 137,000 barrels per day in November and December. Looking ahead, OPEC+ has reaffirmed its decision to pause further production hikes at least through the first quarter of 2026, citing seasonal demand patterns and continued market uncertainty. OPEC+ has also repeatedly adjusted or postponed planned increases in response to evolving market conditions.

- On April 2, 2025, the United States announced global tariffs with broad economic implications expected to be detrimental to crude oil demand. Although these tariffs have been paused intermittently, the U.S. continues to maintain a nominal 10% tariff on Canadian oil and gas products. Almost all Canadian oil exports—including those from Newfoundland and Labrador—continue to enter the U.S. duty free due to compliance with the Canada United States Mexico Agreement, and this exemption remains in place for qualifying products.

- Ongoing geopolitical events—such as the Russia–Ukraine war and U.S. actions in Venezuela—along with structural changes related to the global energy transition continue to influence market dynamics. Sanctions on Russia and Venezuela have constrained supply, while global adoption of electric vehicles and shifts toward lower emission fuels have moderated demand growth.

- Global forecasts indicate that oil supply growth is expected to outpace demand growth in 2026, contributing to sustained downward pressure on prices. The U.S. Energy Information Administration (EIA) projects the Brent benchmark to average approximately US$56 per barrel in 2026, down from US$69 in 2025, as rising global inventories and strong non-OPEC+ production continue to weigh on markets. The EIA also notes elevated oil on water volumes and record high inventories in late 2025, reinforcing expectations of a well-supplied market entering 2026.

The estimated value of Newfoundland and Labrador’s crude oil output is in Canadian dollars; the average Canada-U.S. exchange rate in December 2025 stood at 72.5 cents/U.S. dollar, compared to 70.2 cents/U.S. dollar in December 2024.

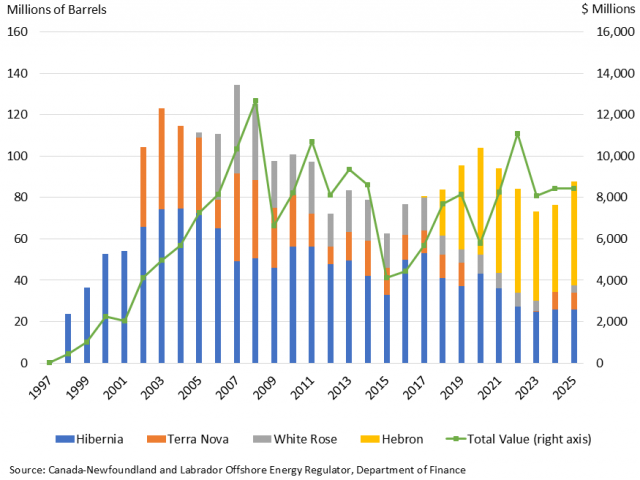

On an annual basis, the volume of oil production extracted from offshore Newfoundland and Labrador totalled 87.6 million barrels in 2025, the highest production level since 2021 and an increase of 14.6% compared to 2024. Despite this growth in volume, the corresponding total value of production remained essentially unchanged (+0.02%), as the annual average crude oil price fell by 14.2%, marking the third consecutive yearly decline.

- Production at Hibernia remained steady (+0.1%).

- Production at Terra Nova decreased by 7.5%, with 2025 marking the second full year of operation for the oilfield after an interruption that lasted nearly four years.

- Production at Hebron increased by 19.7%, contributing significantly to overall growth.

- White Rose resumed production in March 2025, and recent output levels have been comparable to the monthly production recorded in 2023 prior to the oilfield being shut down for the SeaRose refit.

Further information on the province’s oil and gas industry is available in The Economy 2025 (see Oil and Gas section).

Statistical Reference: Statistics used in this analysis were current at the time of writing. For the latest in oil production statistics visit the Newfoundland & Labrador Statistics Agency site.